Investment Research for Financial Advisors + Institutions.

Conway was founded on the belief that insights create impact. As an investment research partner, we connect you with a wide array of data — always meticulously sourced and thoughtfully prepared. All research is accessible 24/7/365 on our secure platform and may be private labeled to suit your needs.

Who We Serve

We partner with registered investment advisors, trust companies and institutions to add guidance and expertise to their investment strategies.

Manager Due Diligence

Manager selection is critical to the overall performance of both traditional and alternative investments. Our approach combines qualitative and quantitative analyses in order to identify, evaluate and select managers that add lasting value to your portfolio.

- Global Equities & Fixed Income

- Mutual Funds

- Interval Funds

- ETFs

- Hedge Funds

- Private Equity/Credit

- Real Estate/Real Assets

- ESG/Impact

Operational Due Diligence

How a fund manager operates can be just as important as its investment performance. During operational due diligence, we conduct questionnaires, on-site visits and vendor checks in order to identify and evaluate any potential business risks of the fund manager.

- Policies + Procedures

- Third-Party Vendor Verification

- Operational Checks + Balances

- Regulatory + Compliance

Capital Markets Research

Our industry has no shortage of market research and the volume can be overwhelming. Our approach synthesizes this research into clear, understandable and thoughtfully packaged reports to help our clients make informed investment decisions.

- Daily Index Performance

- Monthly Newsletter

- Quarterly Market Outlook

- Quarterly Asset Class Rankings

- Annual Capital Market Expectations

Asset Allocation + Model Portfolios

Asset allocation and portfolio construction are the foundation of a strong portfolio. Our unique approach leverages proprietary capital market assumptions and asset class views to create efficient and customized portfolios.

- Asset Allocation

- Model + Customized Portfolios

- Investment Policy Statement Creation + Support

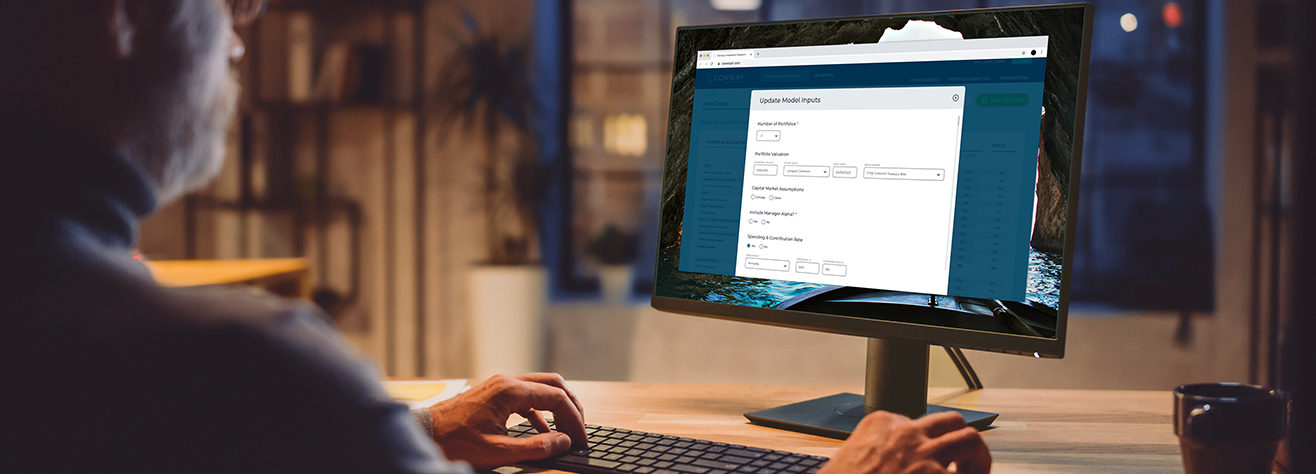

Branded Advisor Research Portals

All Conway research is organized and hosted on a secure online platform that is branded to your practice or institution. The portal provides efficient access to investment information so advisors can have data at their fingertips.

- Seamless Brand Experience for Advisors + Clients

- Unified Investment Research + Technology Tools

- Efficient Access + Investment Information on Demand

Contact Us

Fill out the form below and a member of our team will be in touch shortly.